If you’re planning to buy a car or take out any type of loan, understanding how to calculate your monthly payments is essential. Excel offers a powerful, easy-to-use solution for this. In this article, we’ll walk you through how to calculate car payments in Excel using built-in formulas—and show you how the same method applies to mortgages, personal loans, student loans, and more.

Why Use Excel to Calculate Car Payments?

Excel is more than just a spreadsheet—it’s a versatile financial tool. With just a few inputs, you can determine your monthly loan payments, interest paid over time, and even build an amortization schedule. Whether you’re financing a car or managing debt, Excel helps you make smart financial decisions with clarity and precision.

Step-by-Step: How to Calculate Car Payments in Excel

Excel has a built-in function called PMT that makes calculating car or loan payments quick and simple.

Syntax of the PMT Function

PMT(rate, nper, pv, [fv], [type])

Here’s what each argument means:

- rate – The interest rate for each period (monthly interest rate)

- nper – Total number of payment periods

- pv – Present value, or the loan amount

- fv – [Optional] Future value (defaults to 0)

- type – [Optional] When payments are due: 0 = end of period, 1 = beginning (defaults to 0)

Example: Calculate a Car Loan Payment

Let’s say you’re financing a $25,000 car with:

- Interest rate: 6% annually

- Loan term: 5 years (60 months)

- Down payment: $5,000

You’ll be borrowing $20,000 ($25,000 – $5,000).

Step 1: Input Your Values in Excel

| Description | Value |

|---|---|

| Loan Amount (pv) | 20000 |

| Annual Interest | 6% |

| Term (months) | 60 |

| Monthly Rate | =6%/12 |

Step 2: Use the PMT Formula

PMT(0.06/12, 60, -20000)

Note: The loan amount is entered as negative because it’s an outgoing payment.

Result:

$386.66

You’d pay $386.66 per month for 60 months to repay the loan.

How This Applies to Any Loan

This method isn’t limited to car loans. You can use it to calculate payments for:

- Home mortgages

- Student loans

- Personal loans

- Business loans

- Credit card debt (with fixed payments)

Just plug in the relevant interest rate, term, and principal amount.

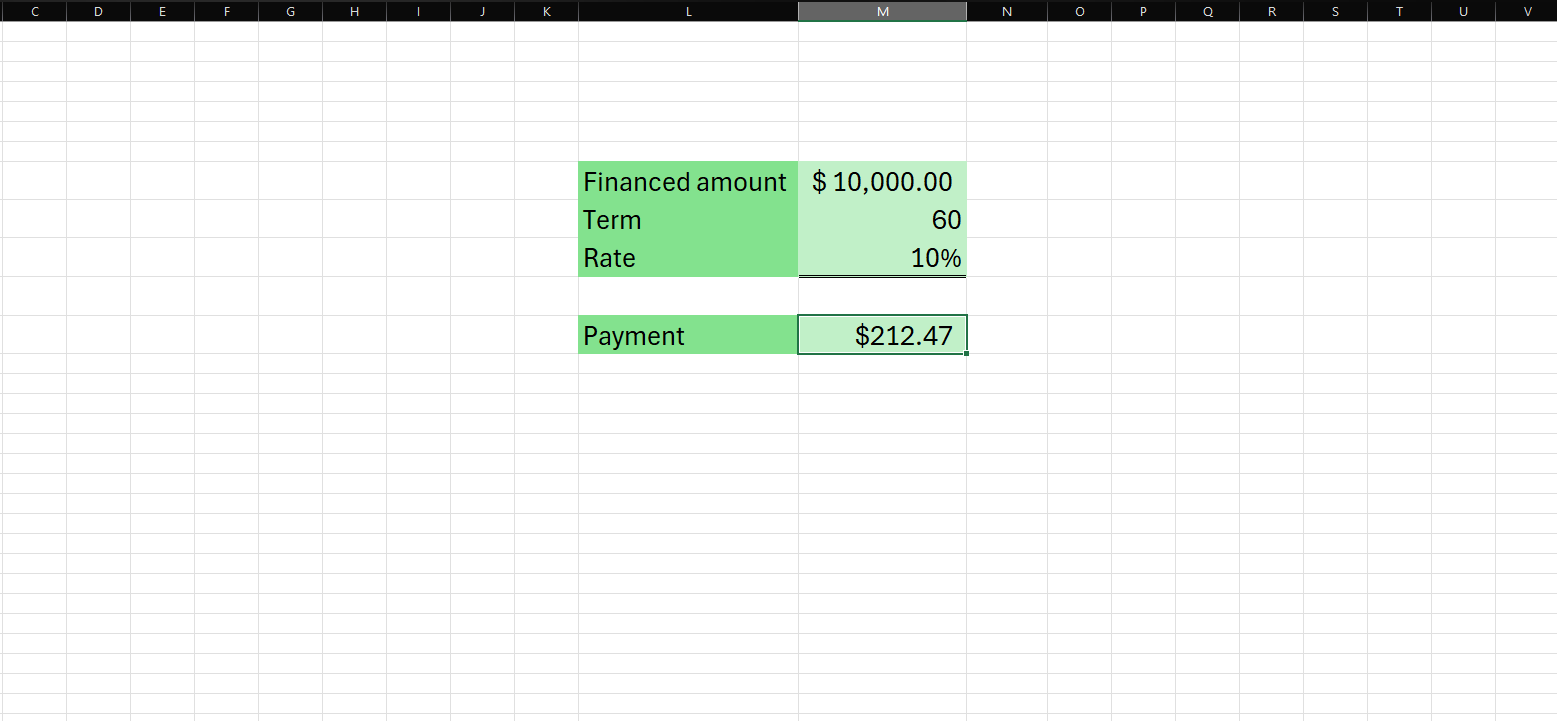

Bonus Tip: Create a Dynamic Calculator in Excel

To make this even easier, set up your spreadsheet like this:

| A | B |

|---|---|

| Loan Amount | 20000 |

| Annual Interest | 6% |

| Loan Term (months) | 60 |

| Monthly Payment | =PMT(B2/12, B3, -B1) |

Now you have a dynamic calculator—just change the loan amount, rate, or term, and Excel will update the payment automatically.

Tips for Accuracy and Optimization

- Always divide the annual interest rate by 12 to get the monthly rate.

- Use negative signs for outgoing payments to format results correctly.

- Format your result cell as Currency for clear readability.

- You can use FV and Type in special cases (e.g., balloon loans or upfront payments).

Learning how to calculate car payments in Excel is a game-changer for managing your finances. With just one formula, you can plan for your next vehicle—or handle any loan with confidence. Excel empowers you to understand exactly what you’ll owe, avoid surprises, and make better borrowing decisions.

Whether you’re buying a car, planning a mortgage, or consolidating debt, mastering the PMT function in Excel gives you full control over your financial future.